You’ve decided to become a freelancer. You’re the boss of your own time, your business, and the projects you choose to work on. There’s a lot going on, from finding new clients to managing your workload. The truth is… you kind of have to do everything, especially when you’re just starting out.

To maximize your chances of success, one of your first decisions as a freelancer is how to manage your processes – especially your invoices, accounting, clients, and projects.

To find, retain, and receive glowing reviews from clients, you need an efficient and scalable way to stay on top of invoicing, accounting, time tracking, and client management. Otherwise, it’s all too easy to neglect the billable tasks that build your business and always be playing catch-up.

After a lot of testing, here’s our pick of the best freelancer apps to manage your business and prime your freelance career for max results.

7 Best Apps for Freelancers in 2021

FreeAgent is a popular, all-around accounting tool that tracks your time, manages projects, sends invoices, and preps your tax return. It’s especially powerful for freelancers and small businesses in the UK.

Although FreeAgent’s user experience is a bit more old-school than some of the other apps for freelancers in this post, it works remarkably well in a huge range of use cases.

If you’re paid in multiple currencies and use an app like TransferWise to receive and convert money, FreeAgent provides an easy way to streamline accounting. It’s simple to invoice clients in the right currency, then record payments in that currency and instantly convert to your home currency, too.

As FreeAgent connects to many popular banks, it’s easy to automatically add expenses made on a business card. Or, you can import a CSV of bulk expenses.

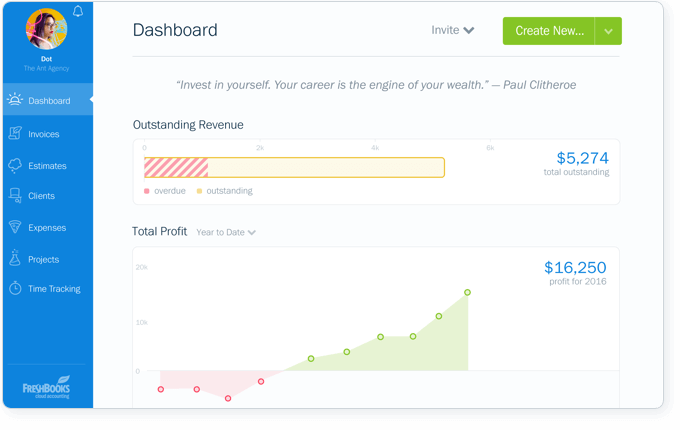

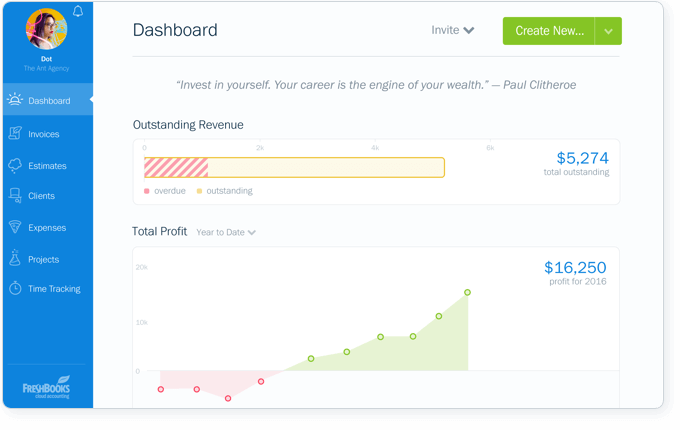

On the FreeAgent dashboard, there’s a quick overview of all of your freelance business’s key metrics at a glance:

FreeAgent has separate websites for the UK, the US, and the rest of the world to give you the most relevant information. For FreeAgent users in the UK, you can use the software to prepare your Self Assessment forms and view a handy timeline of your tax estimates at any time of year.

FreeAgent could be the best freelancer software for you if:

- You’re based in the UK and want built-in Self Assessment and tax timelines

- You get paid in several currencies

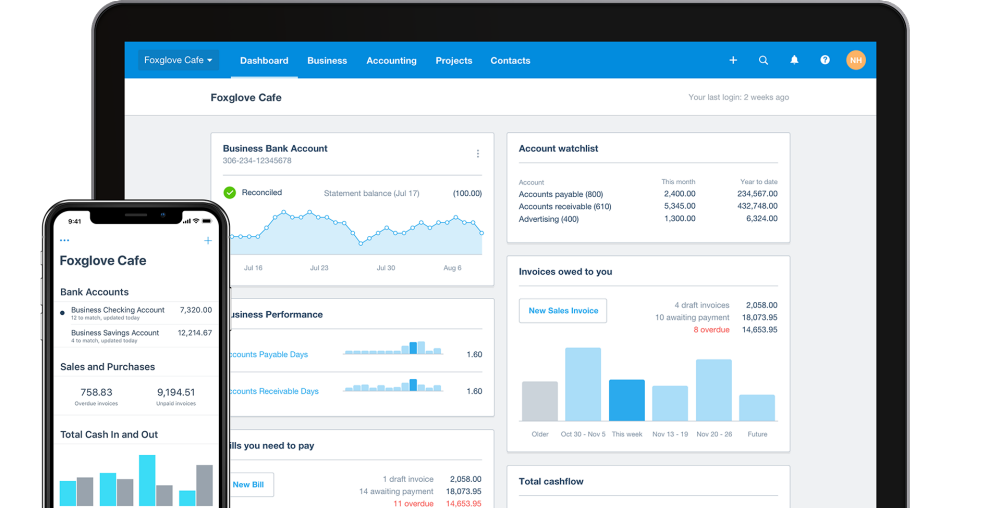

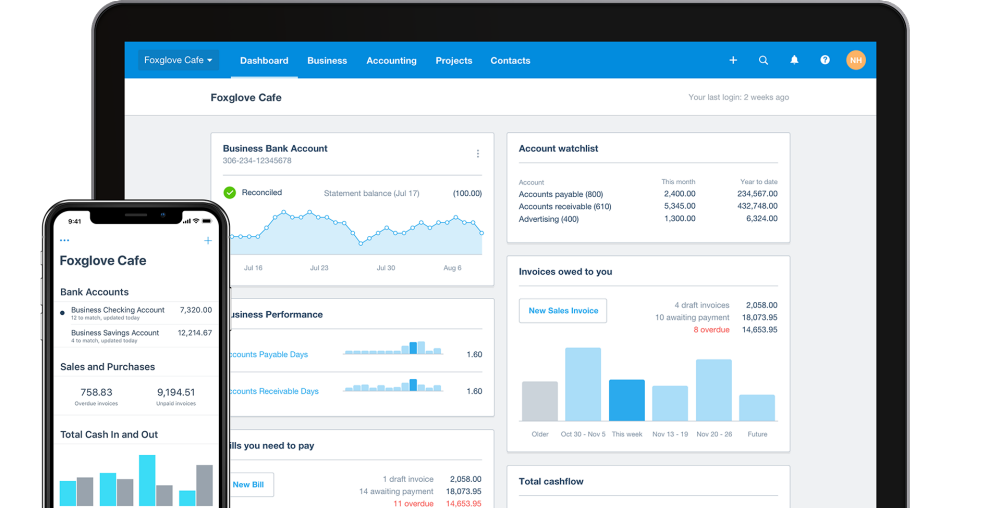

Xero is one of the most popular accounting systems on the market, offering freelancers a higher-end solution to manage their pipeline and accounts.

Along with QuickBooks, Xero is one of the most popular accounting tools on the market. It’s extremely user-friendly, beautifully designed, and is perfect for freelancers planning to scale up their business in the next few years. You can just switch to the next plan whenever you’re ready for more power from Xero.

Xero is laser-focused on saving you time as a freelancer – connecting directly to your bank, creating and following up with invoices at speed, and integrating with your favorite business apps. With Xero’s Hubdoc data capture and automatic entry tool, you can cut paperwork clutter and save even more time.

As a freelancer, you can choose between Xero’s three plans: Early ($9/month), Growing ($30/month), and Established ($60/month). However, we recommend the most expensive of those three tiers – the Established plan – as this is the only plan that includes multi-currency, time tracking, and project cost tracking features.

Xero is also valuable for freelancers with a growing retail business. The accounting platform seamlessly connects with leading ecommerce apps for point of sale transactions (such as Square), inventory (such as CIN7), as well as payment systems like Stripe and PayPal.

Xero could be the best freelancer software for you if:

- You want strong native integrations with your other favorite apps

- You want instant bank reconciliation for transactions

- You want retail app integrations

- You have an accountant who is a Xero partner

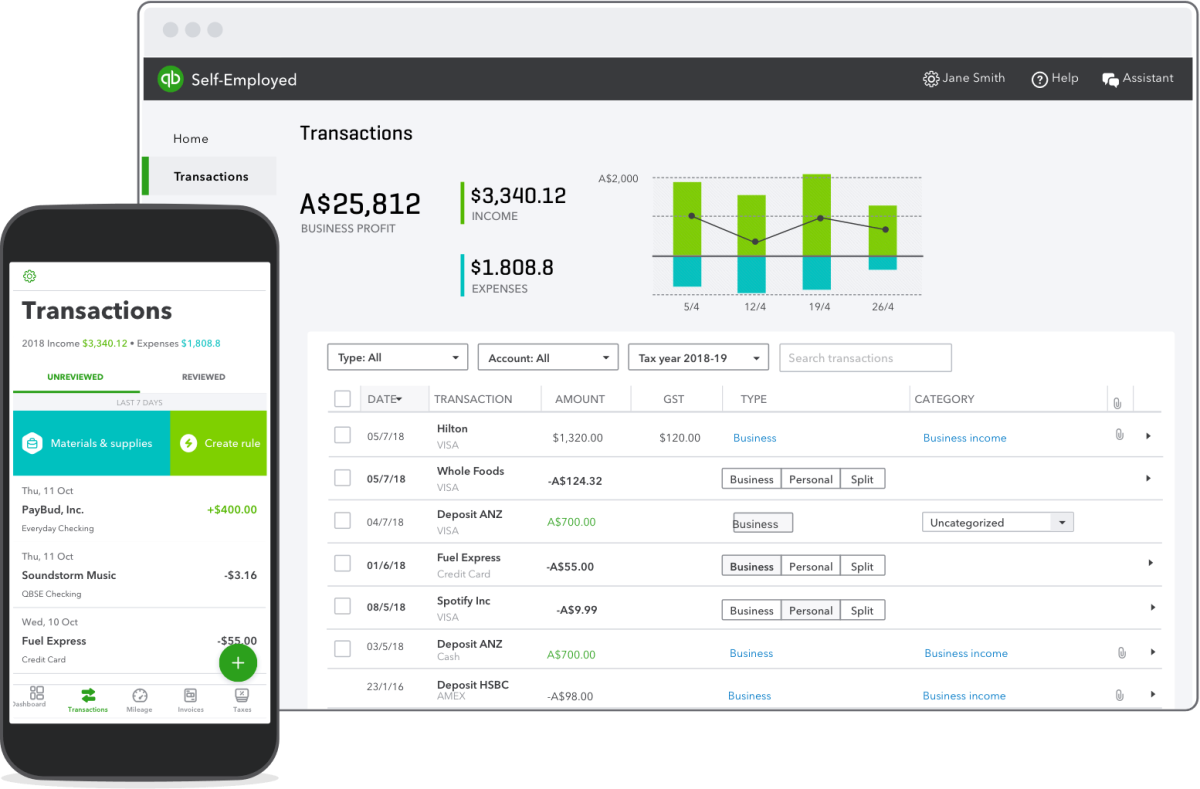

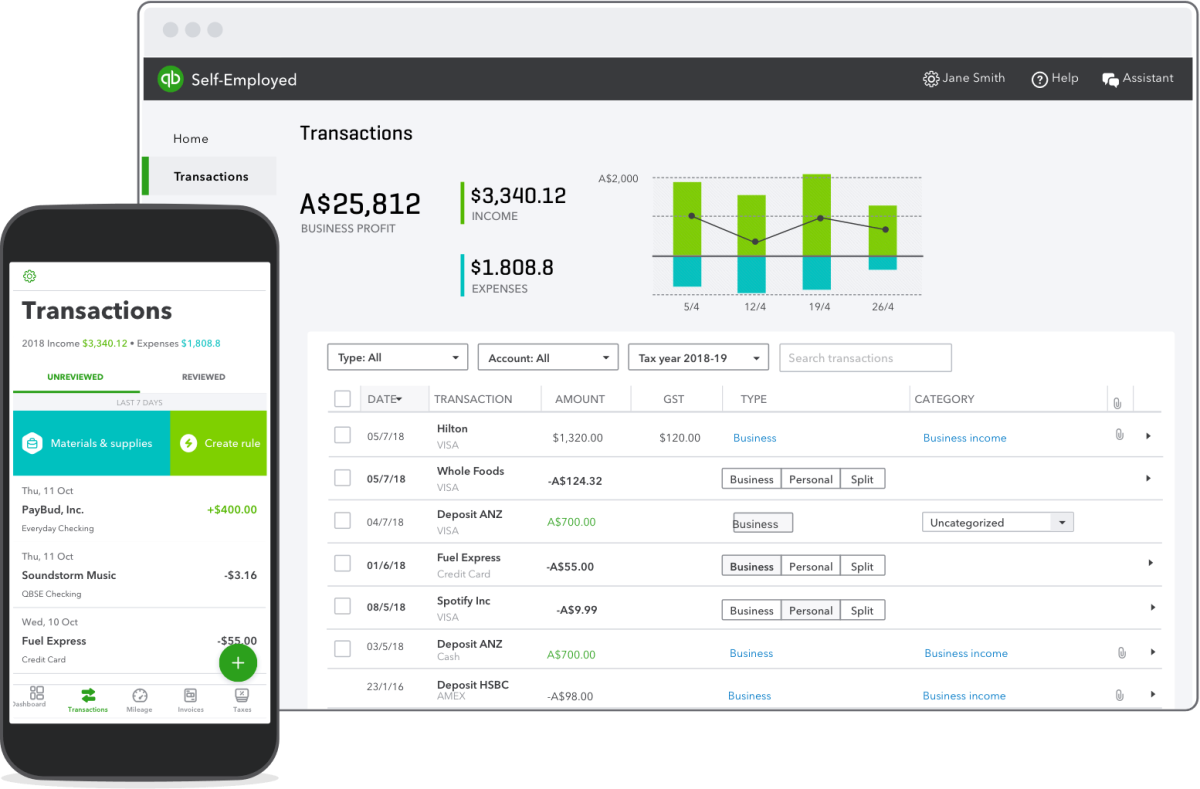

QuickBooks is the market leader in accounting software and a great fit for many small businesses, although freelancers can find it hard to find the perfect plan.

If I ask you to name an accounting software, there’s a high chance QuickBooks will spring to mind. With QuickBooks Self-Employed, freelancers can access a lighter plan than the most popular cloud-based product (QuickBooks Online) offers.

However, QuickBooks Self-Employed has its limitations. Although you can send and track simple invoices, track mileage, and separate business and personal expenses, there’s limited scope for customization and no time tracking functionality in this plan. For this, you’ll need to choose a QuickBooks Online plan for small businesses instead.

Once you choose a QuickBooks plan, your freelance business is in a great position to scale: you can switch plans and products as and when you need to.

QuickBooks is also one of your best choices if you want a wide range of integrations and a comprehensive feature set.

QuickBooks could be the best freelancer software for you if:

- You’re planning on scaling your freelance business in the next few years or becoming an agency

- You want strong native integrations with your other favorite apps

- You want instant bank reconciliation

- You have an accountant who is a QuickBooks partner

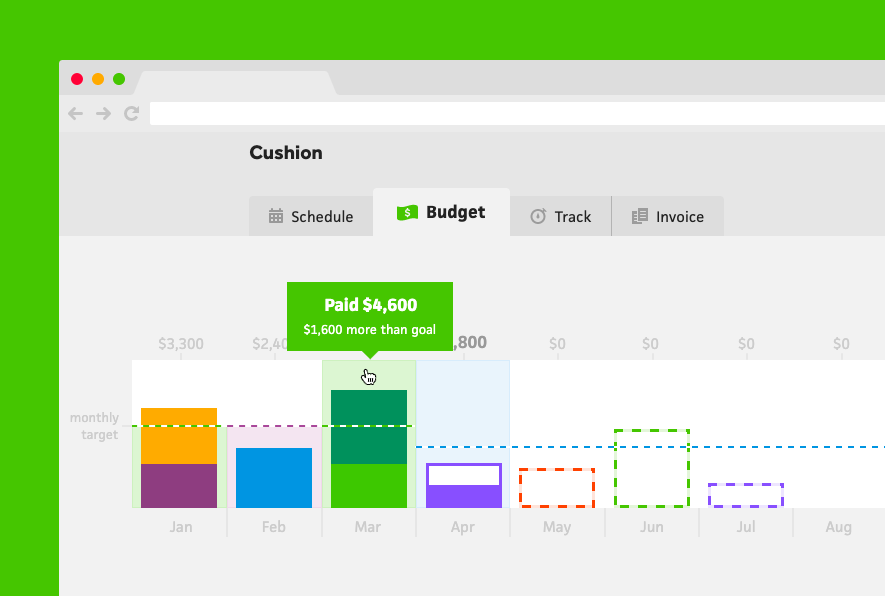

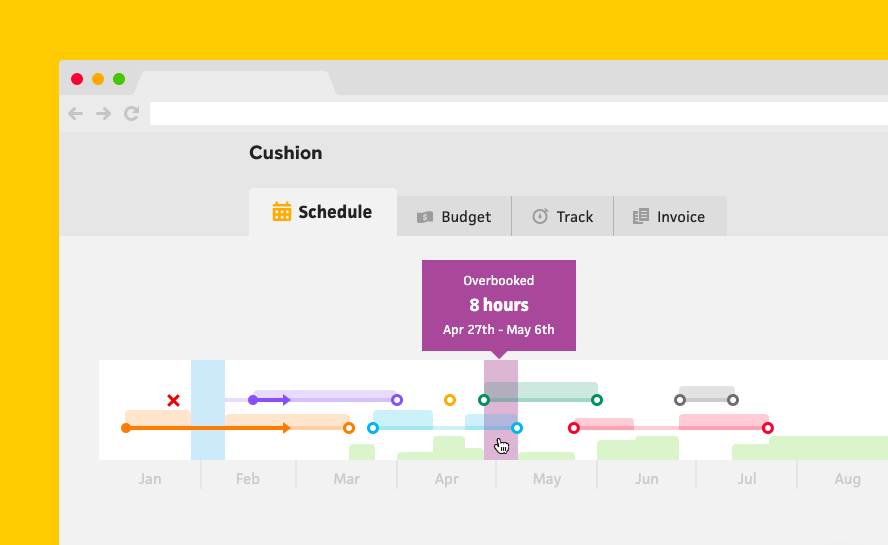

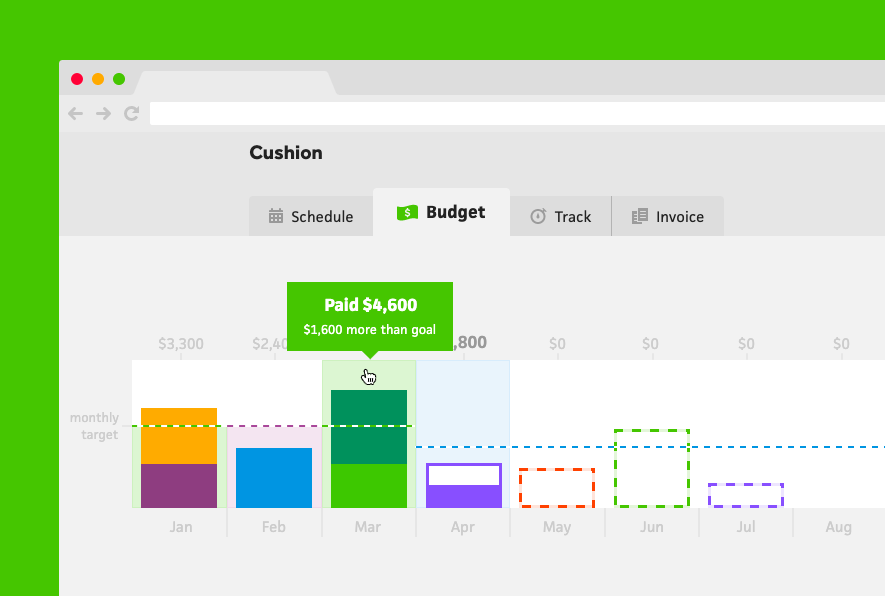

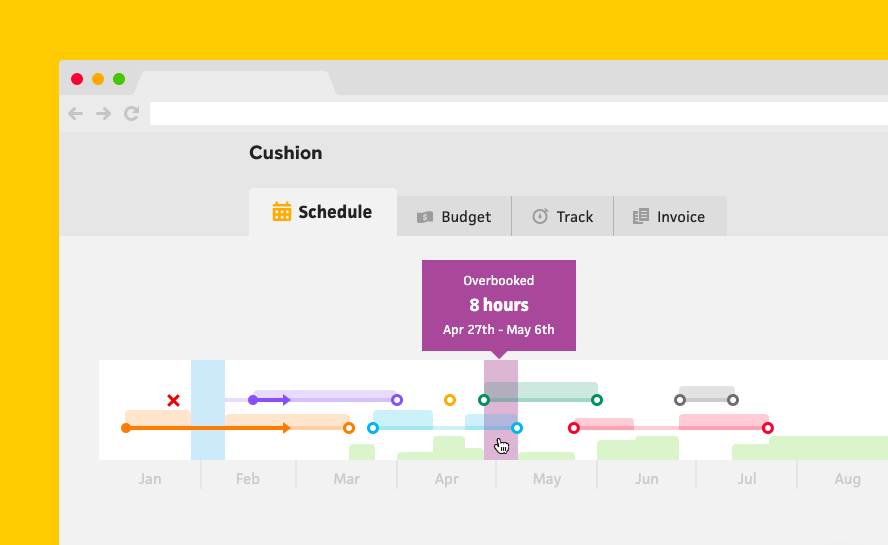

Designed to give freelancers a clearer view of their workload and availability, Cushion improves cash flow while offering strong invoicing and time tracking features.

Cushion promises “Peace of mind for freelancers,” providing beautiful UX and unique features to help you avoid taking on too much work. It’s easy to visualize future workload, earnings, expenses, and invoices, so freelancers can anticipate their financial situation ahead of time.

Where Cushion shines is as an app for freelancers to stay on top of their workload, improve cash flow, and find valuable balance. It’s also easy to track time and invoice clients with the app.

However, you’ll need to use another app to manage core accounting needs such as compiling expenses and income for the tax year. Cushion handily integrates with FreeAgent, FreshBooks, and Xero to enable this.

Cushion could be the best freelancer software for you if:

- You don’t need comprehensive accounting software right now, or you have another system that syncs with Cushion (FreshBooks, FreeAgent, or Xero)

- Your goal is to have a clearer view of your workload and avoid taking on too much work

As a powerful all-in-one small solution for business accounting and invoicing, FreshBooks is a simple but mighty software choice for freelancers and entrepreneurs.

FreshBooks has a great all-around feature set while still being simple to use. For the $15/month Lite plan, you get unlimited customized invoices, expenses, time tracking, estimates, online card payments, and bank transfers. You also get insightful Tax Time reports.

With the Plus plan (from $25/month), you can add more automation to your freelance business, such as with scheduled late payment reminders, recurring invoices, and late fees. You can also access client retainers. The Premium plan is for growing businesses that need to manage up to 500 clients.

FreshBooks could be the best freelancer software for you if:

- You need time tracking functionality at a low price point

- You want unlimited invoices, estimates and card payments

- You prioritize simplicity and ease of use

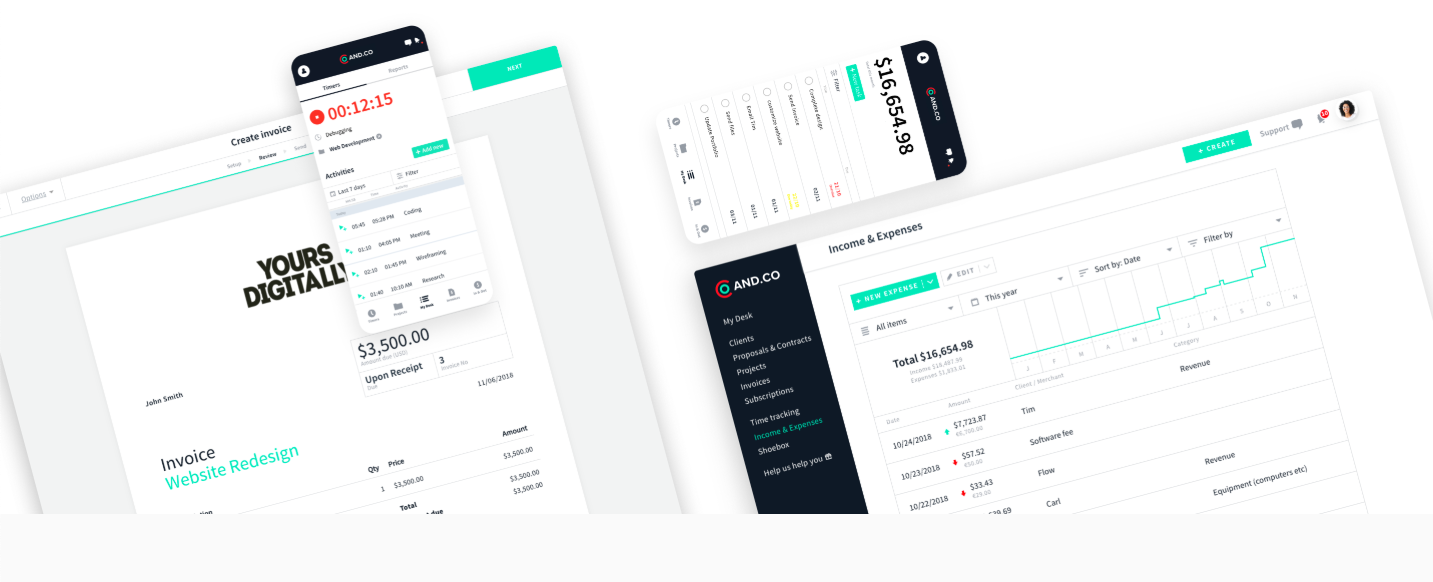

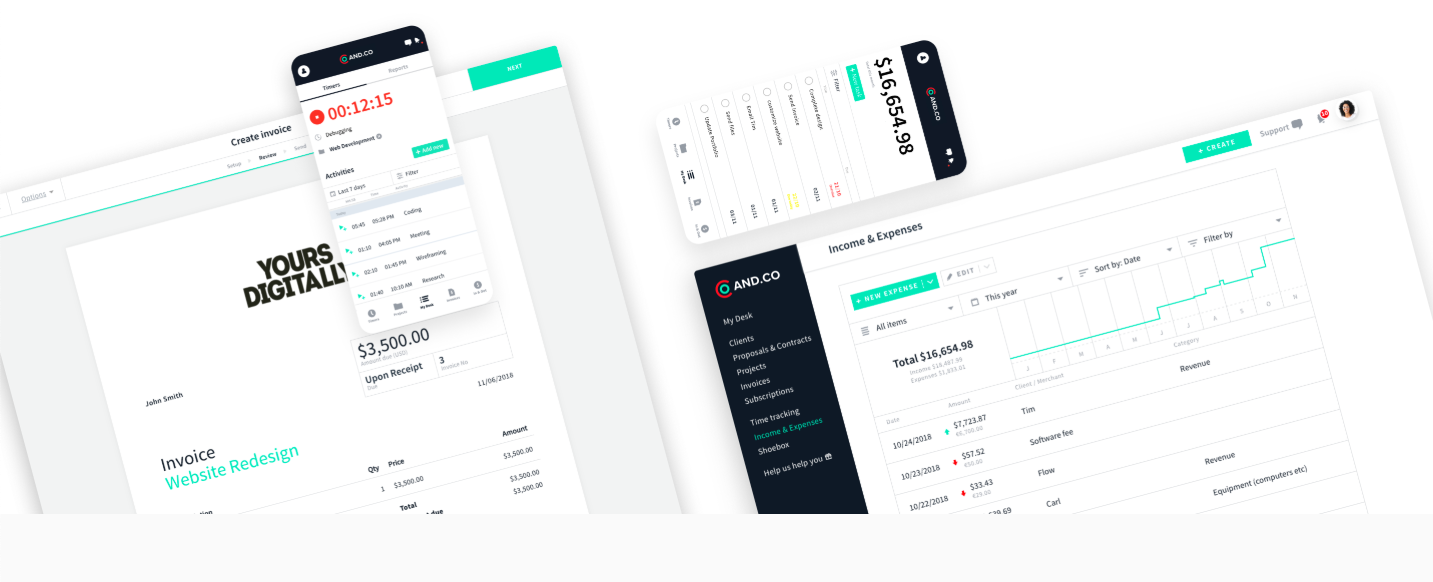

AND.CO is a powerful all-in-one tool for freelancers to manage and grow their business. The platform was acquired by Fiverr in 2018.

AND.CO is an excellent fit for freelancers who are just getting started. Self-titled as “the one app to run your freelance business or studio,” over 300,000 businesses use AND.CO to send proposals, invoice clients, get paid, and manage their time, expenses, and tasks.

Once dubbed “free forever,” AND.CO changed tack and introduced paid plans after being acquired by Fiverr in 2018. You can still get started with its free plan, but this only supports one active client – which isn’t going to cut it for most freelance businesses.

For $18/month, you can manage unlimited clients, remove AND.CO branding, edit contracts, and pay 2.9% + 30 cents for online payments. You can also connect up to six bank accounts to keep track of when invoices have been paid.

AND.CO neatly integrates with your other favorite freelance apps, including Mailchimp, Spotify, and Stripe.

Extra tip: For extra value from AND.CO whether you’re a customer or not, listen to The Six Figure Freelancer audio course for free. AND.CO opens up the mic to top professionals who share their formulas for success in starting, growing, and maintaining six-figure freelance careers.

AND.CO could be the best freelancer software for you if:

- You want to manage unlimited clients

- You don’t need advanced accounting features

- You want a simple user-experience

Financial software that offers freelancers the most value at the lowest price point – you require exactly zero budget to get started.

Wave is a very popular tool for freelancers for good reason – it’s free. The financial software for entrepreneurs offers the core accounting, invoicing and receipt scanning features you need to make running your freelance business a breeze. You can pay-per-use for access to online payments if required.

Here’s a glimpse of the Wave integration with Stripe to track cash flow, profit and loss, and overdue invoices:

Wave could be the best freelancer software for you if:

- You have a limited budget and are looking for a free app to manage your freelance business

- Your focus is on invoicing, basic accounting, and receipt scanning

- You don’t need to track mileage, time, or inventory

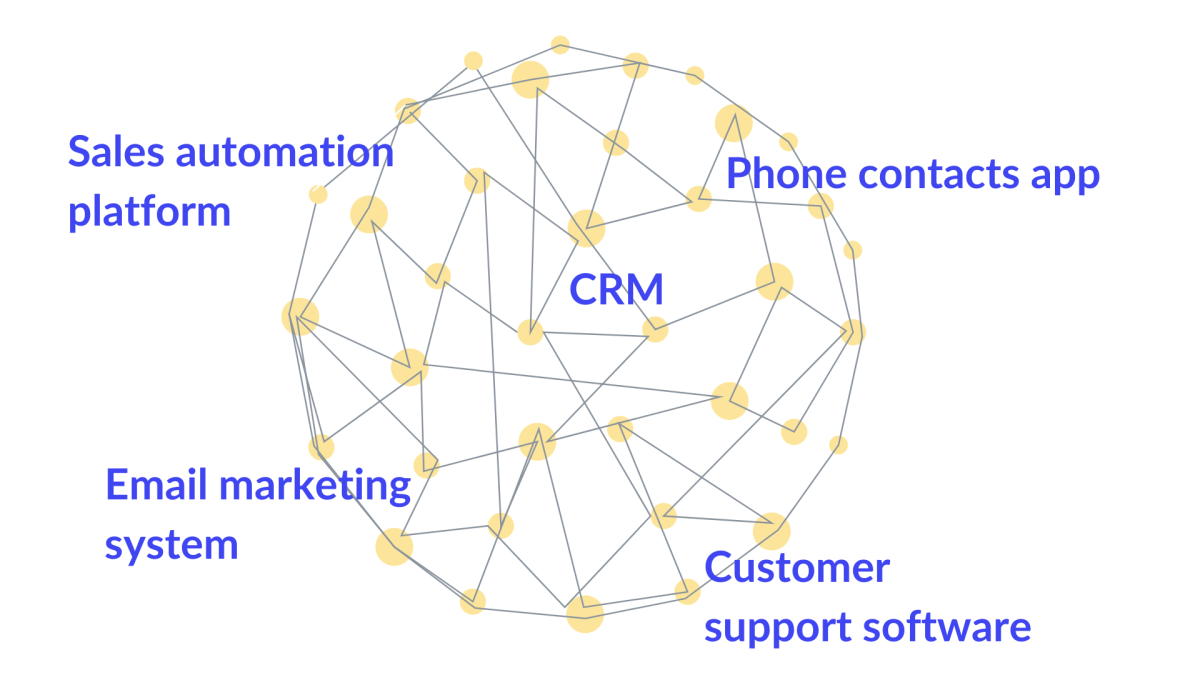

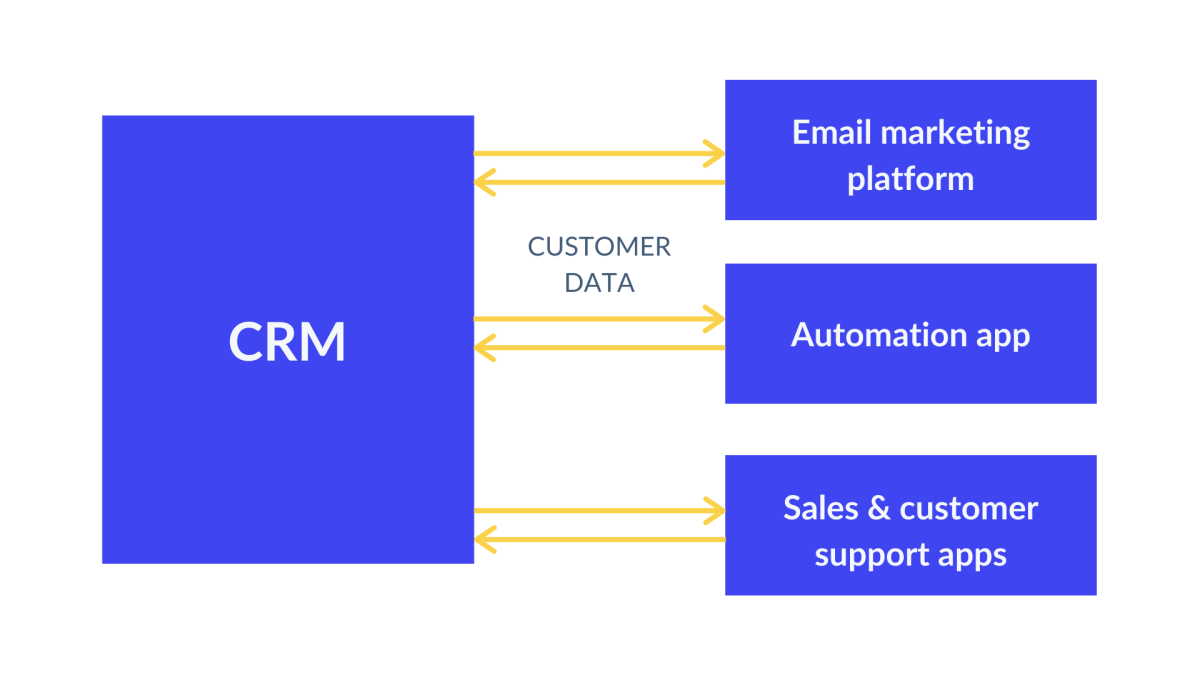

Want to streamline your processes even more? A two-way data sync solution keeps data flowing freely to the right places in your small business, from your freelance management tool to your email marketing provider and CRM.

![]()

![Download Now: How to Be More Productive at Work [Free Guide + Templates]](https://i4lead.com/wp-content/uploads/2021/10/be08853d-7ccb-4ab6-ba13-ef66a1d9b4ff.png)