Whether you want to start a new company or forecast realistic revenue growth, measuring your total addressable market is a crucial first step.

In order to understand how much of the market you can secure — and how much revenue your business can generate — you’ll need the right formula.

In this post, you’ll learn what total addressable market is and the best way to calculate it.

Table of Contents

Unless they’re a monopoly, most companies can’t capture the total addressable market for their product or service. Even if a company just has one competitor, it would still be extremely difficult for them to convince an entire market to only buy its product or service.

That’s why most companies also use other metrics to analyze the market.

Companies can measure their serviceable available market (SAM) to determine how many customers they can realistically reach. Additionally, they gauge their share of market (SOM) to understand the size of their actual target market.

However, TAM is still useful. Businesses can use a total addressable market analysis to objectively estimate a specific market’s potential for growth.

How to Calculate TAM

There are three ways to calculate your business’ total addressable market.

1. Top-down

The top-down approach uses industry data, market reports, and research studies to identify the TAM. In this approach, you might use industry data from Gartner or Forrester to identify which subsections of your industry align with your goals and offerings.

However, there are limitations here. Data generated by industry groups may not always be kept up-to-date and may not reflect niche elements of your market.

You may want to hire a market research consulting firm to conduct fresh research that is focused on your market.

2. Bottom-up

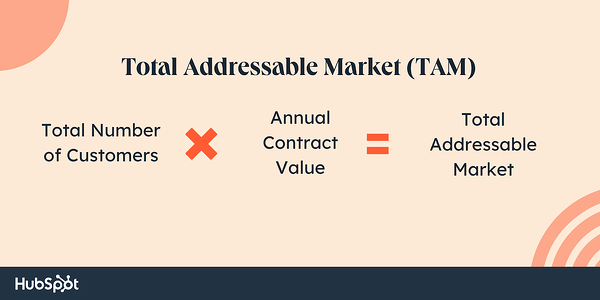

The bottom-up approach to TAM calculation is based on previous sales and pricing data.

First, multiply your average sales price by your number of current customers. This will yield your annual contract value.

Then, multiply your ACV by the total number of customers. This will yield your total addressable market. Let’s see what this looks like in an example.

Say you sell scuba fins to dive shops in the state of California.

You might sell an average of 60 pairs of fins, at $35/pair, to dive shops in California.

60 multiplied by $35 equals an ACV of $2,100. Then, you’d multiply your ACV ($2,100) by the total number of dive shops in California (125) for a total addressable market of $262,500.

3. Value-theory

The value-theory approach is based on how much value consumers receive from your product or service and how much they’re willing to pay in the future for that product or service.

To return to our scuba example, let’s say you manufacture a type of fin that’s lighter than your competitors. You’d identify your value theory by estimating how much dive shops would be willing to pay to carry your superior product.

If normal fins are being sold at $35 a pair, would dive shops pay $40 or even $45 for a pair of your ultra-lightweight fins?

After you calculate your total addressable market, it’s time to determine whether it’s worth entering the industry or not.

An industry with a market size ranging from $30 million to $200 million per year might be worth entering. However, if the industry’s market size is under $5 million per year or over $1 billion per year, it’s probably not.

In both situations, it’d be challenging to persuade investors to back your company. An industry with a market size of $5 million per year would likely be too niche and an industry with a market size over $1 billion would likely be too saturated.

Know Your TAM Before You Take Action

Starting a business or projecting next year’s revenue growth is always thrilling. But if you want to follow a realistic path toward success, you need to first understand what’s actually possible in the market.

Let your total addressable market be your North Star and guide you through a journey that’s rooted in reality, not hype.

Editor’s Note: This post was originally published in Nov. 2020 and has been updated for comprehensiveness.

![]()

![→ Download Now: Market Research Templates [Free Kit]](https://i4lead.com/wp-content/uploads/2023/01/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)