There’s a shift occurring; in our businesses, homes, and media.

You all see the signs. Things are changing all around us.

The Holiday season is upon us!

I love this time of year, personally. It means time with family and some high-quality excuses for whipped cream consumption.

For B2B marketers, however, we mistakenly believe content engagement slows to a halt.

Let’s talk turkey.

B2B Professionals Still Consume Content in Q4

We may feel like the final days of the calendar year mean business activity dies, but recent data from NetLine reveals a different story.

While October is historically the month where consumption rates peak, November and December remain prime months for strategic content marketing and sales engagement.

Thus, contrary to popular belief, B2B professionals remain highly active in the year’s final weeks.

NetLine’s data shows remarkable consistency:

Here’s how November and December registration averages stack up against January through October registration averages.

- 2020:

4.3% lower

4.3% lower

- 2021:

10% higher

10% higher

- 2022:

4.5% lower

4.5% lower

- 2023:

11.1% higher

11.1% higher

(It’s also worth noting that November 2024 is pacing at a similar rate to 2021 and 2023.)

The data suggests that many B2B professionals are using this time to reflect, plan, and prepare for the upcoming year.

It’s not a major surprise in this case, but it is certainly worth further exploration.

Industry-Specific Engagement Trends

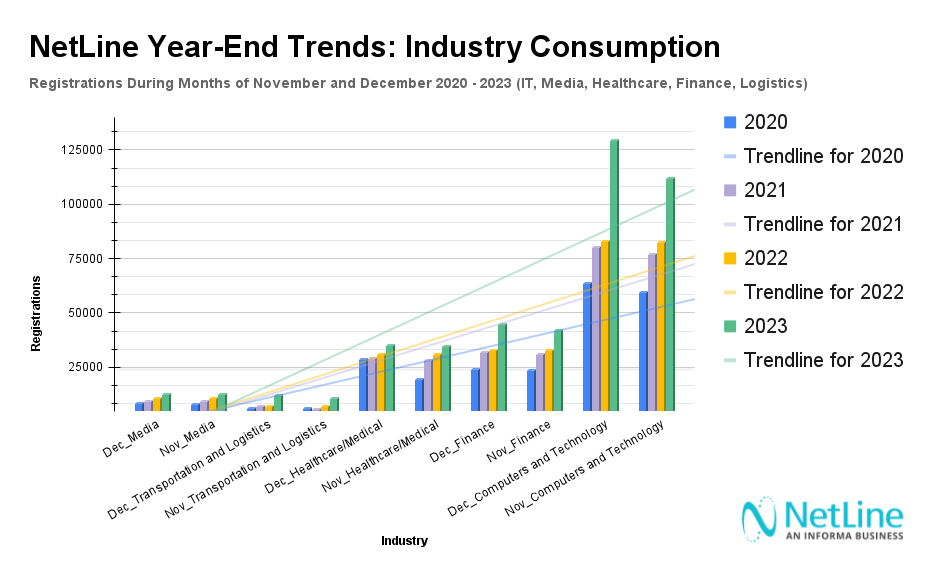

Some industries demonstrate particularly strong end-of-year content engagement.

- Technology: +15% content requests from November to December

- Finance and Healthcare: Significant spikes as budgets finalize

- Transportation and Logistics: Doubled engagement since 2020

Each sector shows unique patterns, but the overarching trend remains consistent: professionals are actively seeking insights and strategic information.

How Much Does Content Consumption Shift from November to December? Content Format Comparison (2020-2023)

Not all content formats maintain equal appeal.

Below is a comprehensive table that includes total registrations, Month-Over-Month (MoM) differences, and percentage deltas for each content format since 2020.

| Content Format | November Total Registrations | December Total Registrations | MOM Delta (%) |

|---|---|---|---|

| eBook | 1.5M | 1.4M | –4.71% |

| Guide (Merged) | 454k | 437k | –3.87% |

| Cheat Sheet | 231k | 228k | –1.52% |

| White Paper | 190k | 177k | –7.03% |

| Article | 148k | 149k | +0.96% |

| Webinar | 65k | 79k | +20.68% |

| Playbook | 42k | 48k | +13.74% |

| Report | 38k | 36k | –6.94% |

| Tips and Tricks Guide | 30k | 28k | –4.75% |

| Research Report | 25k | 24k | –4.50% |

The four formats I want to focus on are smack dab in the middle of this table: White Papers, Articles, Webinars, and Playbooks.

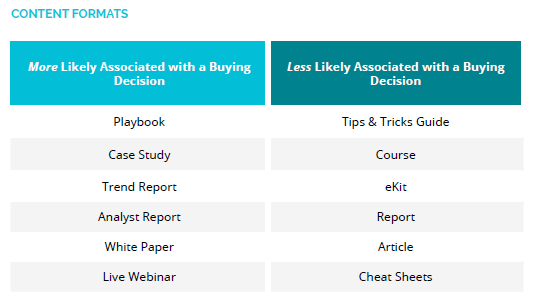

Of this group, Articles are the format least associated with a purchase decision.

For our purposes, we’ll dive further into the three formats with greater intent signals: White Papers, Webinars, and Playbooks.

I highlight these formats due to their high association with purchase intent according to NetLine’s 2024 State of B2B Content Consumption and Demand Report.

The significance here is that B2B professionals registering for these formats are likely preparing for investment in 2025.

Of the three, White Papers are the only format with a significant drop-off. 2021 saw a massive, probably COVID-driven spike, but the format has declined 29.4% since.

Considering that B2B marketers upload more White Papers to NetLine’s platform compared to any other format, this is something marketers must be aware of.

Meanwhile, Webinars and Playbooks have experienced steady, year-over-year growth, with Webinars up 20.6% and Playbooks up 13.7%, respectively.

They hit on some of the key factors marketers and sellers would want to know:

- High Popularity of Format

- High Association of Purchase Intent

- Increased Consumption of Format in December Compared to November

What’s the Point?

If you observe prospects engaging with Webinars and/or Playbooks in the month of December, get in touch with them.

The likelihood of this user making an investment in the near future is higher and therefore should be prioritized.

These figures highlight the most significant growth and declines among content formats.

Understanding Who is Consuming During the Holidays

We’ve demonstrated that B2B professionals remain highly active in content consumption during November and December.

Industries like Technology, Finance, Healthcare, and Transportation show notable engagement spikes with high-intent formats like Webinars and Playbooks seeing increased interest in December

All in all, these signals indicate it’s prime time for marketers to prioritize outreach.

But to whom should you be reaching out to?

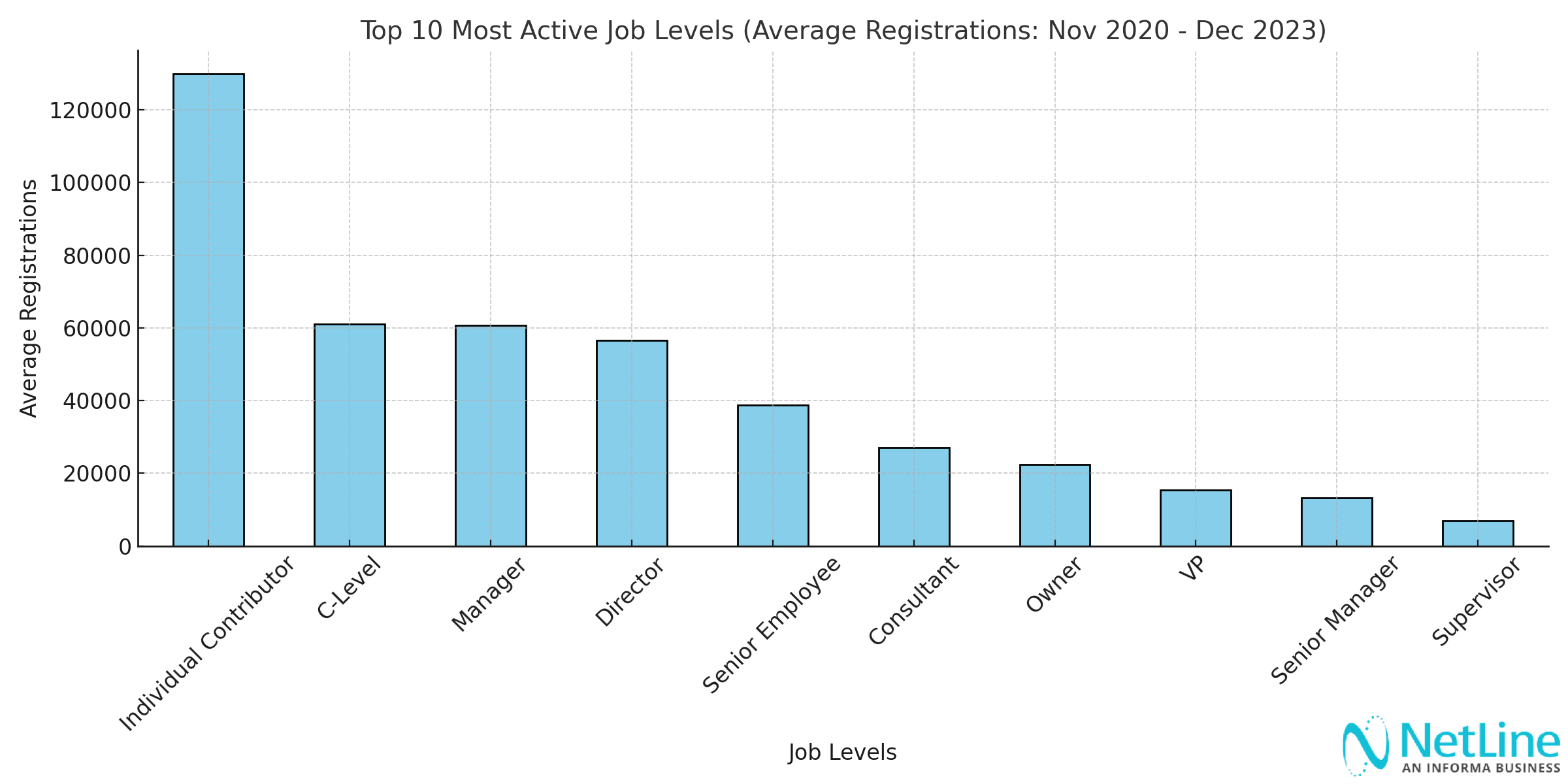

Individual Contributors will always be the most prolific content consumers. They could be involved in the buying committee, but chances are they’re just using your content today to level up.

Throughout the year, the C-Level consumes more content than many expect, especially in the months of November and December.

Here are a few nuggets worthy of being called out:

- C-Level and Director content consumption has grown 28% from November 2021 to November 2023

- November typically sees individual contributors leading engagement

- December becomes dominated by decision-makers finalizing strategies

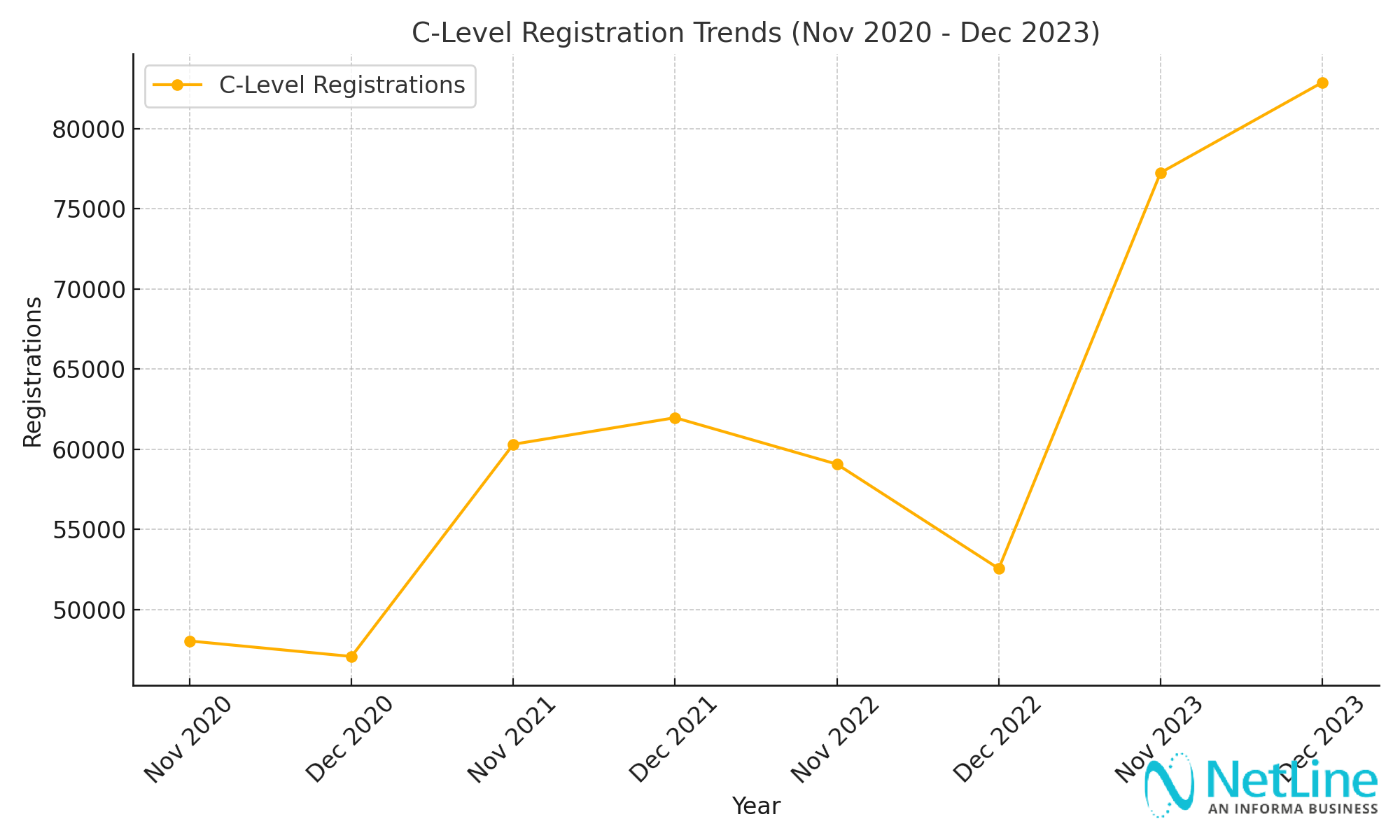

That last bullet is proven by the progression of consumption across the C-Level.

Notice that in years unaffected by a pandemic (2020) or the onset of inflation and recession (2022), C-Level professionals consistently show higher content engagement in December than in November.

We’re still collecting November 2024 data but I’m eager to see what December’s trends look like in the first week of January.

The bottom line here: the C-Suite is looking ahead to the new year. December is a perfect moment to capture their attention.

Which Words Drive Engagement?

Regardless of Job Level, seizing the opportunity can come down to using the right word or two to strike at the right moment.

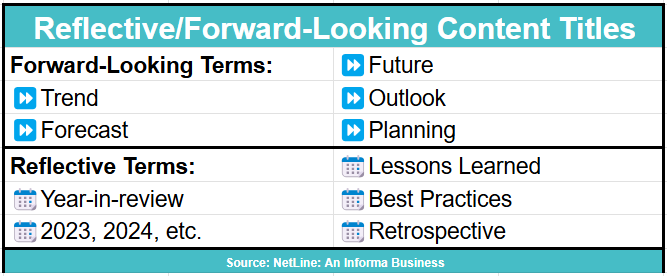

NetLine’s analysis revealed that most registration at this time of year revolves around “Reflective/Forward-Looking Content Titles”.

Reflective/Forward-Looking Content Titles are defined as titles containing keywords that indicate content focused on retrospection, trends, forecasts, or planning for the future.

These titles front assets featuring topics likely to resonate with B2B professionals preparing for the next year or reflecting on past performance.

Here’s an idea of which terms drove the most registrations in November and December.

Strategic keywords can significantly boost content registration.

Push your content to be both forward-thinking and actionable in the moment. It’s a tricky balance, but absolutely worthwhile.

It’s Beginning to Look a Lot Like Q4…

While competitors might be slowing down, you shouldn’t be.

Smart marketers are capitalizing on these final weeks as B2B professionals actively consume and prepare for 2025, and seeking strategic insights.

To take advantage of these insights, focus on these actionable recommendations:

- Double Down on Engagement: Don’t wind down—gear up for Q4 opportunities

- Prioritize Interactive Formats: Focus on webinars and playbooks

- Create Targeted Content: Develop ROI-driven, future-focused assets

- Leverage Seasonal Keywords: Use reflective and forward-looking language

Five weeks remain in 2024—make them count.